What is Demand Draft? – The Demand Draft is a pre-paid Negotiable Instrument, wherein the Drawee bank undertakes to make payment in full when the instrument is presented by the payee for payment. Find demand draft charges and their specific features. The demand draft is made payable on a specified branch of a bank at a specified centre. In many transactions cheque is not usually accepted as the drawer and payee are unknown and there will be credit risk as cheque may bounce. So, in such cases Demand Draft is accepted where the transfer of money is guaranteed. DD is valid for period of 3 months.

Needs of Demand Draft

Demand Draft are increasingly losing their place as instruments that has been using for payments. Because most individuals are today making payments through RTGS, NEFT, IMPS mechanism. But still today many offline applications for jobs, examinations, admissions, services, high amount purchases, etc. require DD rather than cheques. As Cheques can be dishonored due to insufficient balance, but Demand Draft cannot be dishonored. This article looks as steps to make a DD offline by filling form and online, what is Demand Draft, how to get DD cancel, what happens when DD expires.

Fields in Demand Draft

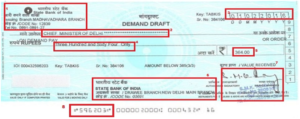

Find sample demand draft image below. We explain various fields in DD below. Sample demand draft is one sent Vizag engineer sends Kejriwal Rs 364 to save CM from embarrassment.

No |

Explanation |

Entry in the DD |

Details |

1 |

Bank branch at the top left |

State Bank of India MADHAVADHARA Branch |

The branch of bank issuing the DD |

2 |

To Pay |

Chief Minister of Delhi |

Who gets the amount specified in the DD |

3 |

Date |

01/02/2016 |

Date of issue of DD (Validity period is 3 months) |

4 |

Amount |

Three hundred and sixty four only |

The amount payable to the party in words |

5 |

Amount |

364 |

The amount payable to the party in figures |

6 |

Branch, at bottom |

State Bank of India |

The branch of bank which pays the amount |

8 |

DD number at the bottom |

596203 |

Number of DD |

7 |

on the right |

Signatures |

Signatures of the officers of branch issuing DD |

Steps to Make Demand Draft

We can make the demand draft by 3 ways

- If you have account in the bank then you can pay by cheque.

- Else you need to pay by cash.

- You can also make DD online.

If you have account in the bank then you can pay by cheque

- Fill the form– Visit any bank and ask for a demand draft application form or fill the form online.

- Form Details– You need to fill up the details like the mode in which you want to pay from your account using cheque, in whose favour the DD is to be made (beneficiary), the amount , the place where DD will be encashed, cheque number, your bank account number, your signature etc

- Demand draft charges– The bank will provide the DD once you submit the form along with the money/cheque and the demand draft charges. The charges vary from bank to bank

- Pan card details– If amount exceeds more than Rs 50,000 and you are paying my cheque then you have to submit PAN card details.

Make Demand Draft by Paying Cash:

- If you not have bank account you can get DD by paying payment slip instead of Cheque as mentioned above.

- The DD issuing bank might seek the ID and address proof and if the amount of DD exceeds Rs.50,000 then PAN Card also would be mandatory. The DD commission for the DDs bought against cash may be higher than that for cheque DDs.

Make Demand Draft by Online

- You can fill details online and can decide to collect in person from your branch or delivered through courier. Through courier it may take 2-5 days. You may get charged for courier.

- Many banks also allow delivering of DD to beneficiary address in India. For example HDFC says they will process All the DD requests on the next working day. They will courier DDs to the mailing address/ provided beneficiary address within 3 to 5 working days.

Demand Draft Charges

Though RBI advocated reasonability of service charges for demand drafts as early as February 2007, it did not prescribe any explicit thresholds or measures of reasonability. So each bank charges own rates for making DD.

Cancellation of Demand Draft

Once you create (Demand Draft) DD, the amount will get deduct immediately from your account. If for any reason, you want to cancel the DD and want to get the deducted money back into your account, you must have to go to the bank. There is no online facility in any banks in India to cancel the DD.

If you already have original DD, there can be two cases.

- Demand Draft by paying cash: If you got the DD by cash deposit, you need to submit original DD as well as receipt of cash payment. Amount will be refundable to you in cash immediately with some deduction of amount.

- Demand Draft from your account: In this case you just need to submit original DD with filled cancellation form. Amount will credit back into your account with some cancellation charge.

If you don’t have Original DD with you then the process of refunding or cancelling the DD it tough.

- To cancel the DD and if you don’t have the original DD with you, you need to sign Indemnity bond in stamp paper for the bank. After that, most of the bank refunds the amount with taking some time i.e. within one week, but some bank will take time till expiry date of DD.

Demand Draft Gets Expire

In India, a demand draft is valid for a period of 3 months from the date of issue. The demand draft will become invalid after 3 months and money will not be automatically refundable. Then the purchaser of the draft should approach the branch concerned bank which issued the draft and submit an application for re-validation of the draft. Please note, the payee (the person named in the draft) cannot approach the bank for re-validation of the draft, or for that matter, any other person.

The draft will be re-validated by the bank branch after verifying their original records, and would extend validity period by another three months from the date of re-validation. A draft which has been re-validated once, cannot be further re-validated, which means that you have to present the draft to the bank within the re-validated period.