Dear Aspirants, LIC HFL is one of the most important exam in the competitive examination. LIC HFL mains exam consists of three sections i.e. Reasoning ability and Numerical Ability, General knowledge & Current affairs and Insurance & Financial Market Awareness. LIC HFL Insurance Awareness & Financial Market Awareness section comprises of 50 questions. LIC HFL Insurance Awareness Questions 2019 play an important role in boosting up the score in mains examination and also helps in the interview. Here we are providing a new series of LIC HFL Insurance Awareness Questions 2019. Aspirants can make use of this LIC HFL Insurance Awareness Questions 2019, to improve score in the Insurance & Financial Market Awareness section.

Check Here for LIC HFL Mock Test Series 2019

Click Here to Subscribe Crack High Level Puzzles & Seating Arrangement Questions PDF 2019 Plan

[WpProQuiz 7147]1) The premium charged by the insurer must incorporate the risk premium that covers not only the claims but also the capital requirements, also called the ________.

a) Liability Requirements

b) Reinsurance

c) Term Insurance

d) General Insurance

e) Solvency Requirements

2) Which of the following is NOT included in motor insurance?

a) Fire and Burglary

b) Riot and Strike

c) Terrorism Act

d) Drunken driving

e) Flood and Storm

3) _______ is an insurance policy provision that adds benefits to or amends the terms of a basic insurance policy.

a) Subrogation

b) Clause

c) Rider

d) Indemnity

e) Cede

4) IRDA has issued the Guidelines on Standard Health Product recently under the provisions of which section of Insurance Act, 1938?

a) Section 32B

b) Section 34 (1) (a)

c) Section 35

d) Section 87A

e) Section 94A

5) Which life Insurer has collaborated with MobiKwik to launch a smart digital insurance product to enhance financial inclusion?

a) Aegon Life Insurance

b) Max Life Insurance

c) Life Insurance Corporation

d) Aviva Life Insurance

e) Bharti AXA Life Insurance

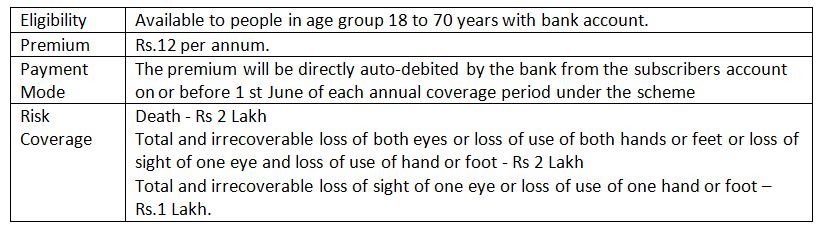

6) Which of the following is NOT true regarding the life insurance cover scheme PMSBY?

a) PMSBY stands for ‘Pradhan Mantri Suraksha BimaYojana’

b) All individual (single or joint) bank account holders in the 18-70 year age group are eligible for scheme

c) The premium payable is Rs 18 per annum per member

d) The risk coverage available is Rs 2 lakh for accidental death and permanent total disability, and Rs 1 lakh for permanent partial disability

e) All of the above

7) An investment to reduce the risk of adverse price movements in an asset is known by which of the following terms?

a) Bailout

b) Hedge

c) Dear Money

d) Par Value

e) Severance Pay

8) Which of the followings payment banks has tied up with Bharti AXA General Insurance to offer two-wheeler insurance recently?

a) Fino Payments Bank

b) Airtel Payments Bank

c) Jio Payments Bank

d) Paytm Payments Bank

e) India Post Payments Bank

9) Which among the following Insurance company has launched Mosquito Disease Protection Policy recently?

a) Bajaj Allianz General Insurance

b) Bharti AXA General Insurance

c) HDFC ERGO General Insurance

d) National Insurance Company Limited

e) Reliance General Insurance

10) When was Oriental Insurance Company Ltd. incorporated?

a) 5 December 1906

b) 12 September 1947

c) 25 January 1961

d) 1 September 1956

e) 1 December 1972

Answers :

1) Answer: E)

The premium charged by the insurer must incorporate the risk premium that covers not only the claims but also the capital requirements, also called the solvency requirements. In the event that the matching is not done in a pragmatic manner, the underwriting risk arises.

2) Answer: D)

Fire and Burglary, Riot and Strike, Terrorism Act, Flood and Storm, Earthquake etc. all such incidents are covered under motor insurance.

The auto insurance does not include: Consequential loss, depreciation, mechanical and electrical breakdown, failure or breakage, When vehicle is used outside the geographical area, War or nuclear perils and drunken driving.

3) Answer: C)

Rider is an insurance policy provision that adds benefits to or amends the terms of a basic insurance policy. A rider is also referred to as an insurance endorsement. It can be added to policies that cover life, homes, autos, and rental units.

4) Answer: B)

IRDA has issued the Guidelines on Standard Health Product recently (February) under the provisions of Section 34 (1) (a) of Insurance Act, 1938. Section 34 deals with Power of the authority to issue directions.

5) Answer: A)

Aegon Life Insurance has collaborated with MobiKwik to launch a smart digital insurance product to enhance financial inclusion.

6) Answer: C)

Pradhan Mantri Suraksha BimaYojana (PMSBY – for Accidental Death Insurance):

7) Answer: B)

A hedge is an investment to reduce the risk of adverse price movements in an asset. A hedge consists of taking an offsetting position in a related security.

8) Answer: B)

Airtel Payments Bank has tied up with Bharti AXA General Insurance for a two-wheeler insurance product offering which is available on My Airtel App and at over 40,000 Airtel Payments Bank points across India.

9) Answer: C)

HDFC ERGO General Insurance Company launched a scheme termed ‘Mosquito Disease Protection Policy’ which will cover a person against common mosquito-borne diseases, namely, Dengue Fever, Malaria, Chikungunya, Kala-azar, Zika Virus etc.

10) Answer: B)

The Oriental Insurance Company Ltd. was incorporated at Mumbai on 12th September 1947. The Company was a wholly owned subsidiary of The Oriental Government Security Life Assurance Company Ltd and was formed to carry out General Insurance business. The Company was a subsidiary of Life Insurance Corporation of India from 1956 to 1973 (till the General Insurance Business was nationalized in the country.