REGULATORY UPDATES

RBI extended deadline for periodic KYC update till march 31 2022

- The Reserve Bank of India (RBI) has extended the last date for KYC updation for bank accounts by three months to March 31 2022.

- Extension was came in view of prevalent uncertainty due to new variant of COVID-19 – Omicron.

- The central bank had relaxed the rules first in May last year due to the pandemic and had said banking services should not be restricted just because the KYC documents have not been updated by the customer.

- KYC documents –Passport, Voter’s Identity Card, Driving Licence, Aadhaar Letter/Card, NREGA Card, PAN Card etc.

- The Know Your Client (KYC) or Know Your Customer (KYC) is a process to verify the identity and other credentials of a financial services user

- The objective of KYC guidelines is to prevent banks from being used, by criminal elements for money laundering activities.

- Government has also extended the deadline for businesses to file GST annual returns for 2020-21 fiscal ended March 2021 by two months till February 28.

- GSTR 9 is an annual return to be filed yearly by taxpayers registered under the Goods and Services Tax (GST). It consists of details regarding the outward and inward supplies made or received under different tax heads.

RBI Retains SBI, ICICI Bank, HDFC Bank as D-SIBs 2022

- Reserve Bank of India has retained State Bank of India, ICICI Bank and HDFC Bank as Domestic Systemically Important Banks (D-SIBs).

- These three banks have continued to be on the D-SIBs list published by RBI, since Sep 04, 2017.

- The Reserve Bank had issued the Framework for dealing with Domestic Systemically Important Banks (D-SIBs) on July 22, 2014.

- The D-SIB framework requires the Reserve Bank to disclose the names of banks designated as D-SIBs starting from 2015 and place these banks in appropriate buckets depending upon their Systemic Importance Scores (SISs).

Classification:

The D-SIBs banks are classified into 5 buckets. Bucket 1, Bucket 2, Bucket 3, Bucket 4 and Bucket 5.

- With Bucket 5 being the most important followed by rest in decreasing order.

- State Bank of India is in Bucket 3, while ICICI Bank and HDFC Bank are in Bucket 1.

- The updated list is based on the data collected from banks as of March 31, 2021.

- Domestic Systemically Important Banks are those banks which if fail would have a significant impact on the economy.

- SIBs are perceived as banks that are ‘Too Big To Fail (TBTF)’.

- This perception of TBTF creates an expectation of government support for these banks at the time of distress.

The Reserve Bank of India (RBI) released the Annual Report of the Ombudsman Schemes

- The Reserve Bank of India (RBI) released the Annual Report of the Ombudsman Schemes for the year 2020-21.The Annual Report covers the activities under the;

1)Banking Ombudsman Scheme, 2006 (BOS),

2)The Ombudsman Scheme for Non-Banking Financial Companies, 2018 (OSNBFC)

3)The Ombudsman Scheme for Digital Transactions, 2019 (OSDT).

- The major areas of complaints under the BOS pertained to

- ATM/debit cards

- mobile/electronic banking

- credit cards,

which collectively accounted for 42.74 percent of the total number of complaints as compared to 44.65 percent in the previous year.

- Under the OSNBFC (the Ombudsman Scheme for Non-Banking Financial Companies) major areas of complaints were

- non-adherence to Fair Practices Code

- non-observance to RBI directions

- levy of charges without prior notice

accounting for 75.32 percent of the complaints as compared to 63.23 percent in the previous year.

- The volume of complaints received under all the three Ombudsman Schemes increased by 22.27 percent on an annualized basis.The BOS accounted for 90.13 percent of total complaints received under the three Ombudsman Schemes.

- The number of complaints received under OSNBFC and OSDT stood at 8.89 percent and 0.98 percent respectively, of the total number of complaints.

- RBI data further highlights that, Chandigarh received the maximum complaints during the same period.Chandigarh is followed by Kanpur and New Delhi

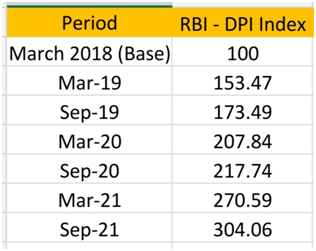

RBI announced digital payment index DPI for September 2021

- The Reserve Bank had announced construction of a composite Reserve Bank of India – Digital Payments Index (RBI-DPI) with March 2018 as base to capture the extent of digitisation of payments across the country.

- The index for September 2021 stands at 304.06 as against 270.59 for March 2021.

- The RBI-DPI Index continues to demonstrate significant growth in adoption and deepening of digital payments across the country.

- The index series since inception is as under:

The RBI-DPI comprises 5 broad parameters that enable measurement of deepening and penetration of digital payments in the country over different time periods.

5 Parameters are;

- Payment Enablers (weight 25%),

- Payment Infrastructure – Demand-side factors (10%),

- Payment Infrastructure – Supply-side factors (15%),

- Payment Performance (45%) and

- Consumer Centricity (5%).

RBI Press release on Consumer Awareness – Cyber Threats and Frauds

- It has come to the notice of Reserve Bank of India that unscrupulous elements are defrauding and misleading members of public by using innovative modus operandi including social media techniques, mobile phone calls, etc.

- In view of this, the Reserve Bank cautions members of public to be aware of fraudulent messages, spurious calls, unknown links, false notifications, unauthorized QR Codes, etc. promising help in securing concessions / expediting response from banks and financial service providers in any manner.

- Fraudsters attempt to get confidential details like user id, login / transaction password, OTP (one time password), debit / credit card details such as PIN, CVV, expiry date and other personal information.

Some of the typical modus operandi being used by fraudsters are –

- Vishing– phone calls pretending to be from bank / non-bank e-wallet providers / telecom service providers in order to lure customers into sharing confidential details in the pretext of KYC-updation, unblocking of account / SIM-card, crediting debited amount, etc.

- Phishing – spoofed emails and / or SMSs designed to dupe customers into thinking that the communication has originated from their bank / e-wallet provider and contain links to extract confidential details.

- Remote Access – by luring customer to download an application on their mobile phone / computer which is able to access all the customers’ data on that customer device.

- Misuse the ‘collect request’ feature of UPI by sending fake payment requests with messages like ‘Enter your UPI PIN’ to receive money.

- Fake numbers of banks / e-wallet providers on webpages / social media and displayed by search engines, etc.

The Liberalised Remittance Scheme (LRS)

- The Liberalised Remittance Scheme (LRS) of the Reserve Bank of India (RBI) allows resident individuals to remit a certain amount of money during a financial year to another country for investment and expenditure.

- Individuals can also open, maintain and hold foreign currency accounts with banks outside India for carrying out transactions permitted under the scheme

- According to the prevailing regulations, resident individuals may remit up to $250,000 per financial year. This money can be used to pay expenses related to travelling (private or for business), medical treatment, studying, gifts and donations, maintenance of close relatives and so on.

- Apart from this, the remitted amount can also be invested in shares, debt instruments, and be used to buy immovable properties in overseas market

- LRS restricts buying and selling of foreign exchange abroad, or purchase of lottery tickets or sweep stakes, proscribed magazines and so on, or any items that are restricted under Schedule II of Foreign Exchange Management (Current Account Transactions) Rules, 2000.

- The Scheme is not available to corporates, partnership firms, HUF, Trusts, etc. The LRS limit has been revised in stages consistent with prevailing macro and micro economic conditions

Subscribe

0 Comments